As we look toward 2025, personal finance trends are changing. The days when people made little to no effort in tracking their spending using an Excel sheet behind closed doors are gone. Quietly managing their failures and/or successes was a thing of the past, and new generations like Gen Z have brought forth an unapologetically LOUD trend called ‘Loud Budgeting.’ Instead of being embarrassed about their finances and keeping things private about what they are spending, saving, or cutting down on, Gen Z is cool talking about anything financial. Itabout about more than finances. It is about being open, transparent, and honest. It is about holding oneself accountable and building a community with friends.

Table of Contents

- What is Loud Budgeting?

- Loud vs. Traditional Budgeting

- Why Gen Z Loves Loud Budgeting

- The Psychology Behind Loud Budgeting

- Key Benefits of Loud Budgeting

- Challenges and Criticisms

- Loud Budgeting in Social Media Culture

- Practical Loud Budgeting Strategies for 2025

- Track Your Spending Publicly

- Use Social Media Accountability

- Join Loud Budgeting Communities

- Set Bold Financial Goals

- Track Your Spending Publicly

- Case Studies: Gen Z’s Loud Budgeting Success Stories

- How Loud Budgeting Impacts Personal Finance Trends

- Loud Budgeting in Pakistan: A Cultural Perspective

- Tools and Apps That Support Loud Budgeting

- Loud Budgeting and Sustainable Finance

- Future of Loud Budgeting in 2025 and Beyond

- FAQs

- People Also Ask (PAA)

- Conclusion

- Call to Action

What does it mean to “Loud Budget?”

when you actively acknowledge your financial limits, savings goals, and financial decision-making in open visibility to others. Examples:

- Saying “No, I can’t go to that extravagant dinner because I’m saving for my laptop.”

- Posting on social media to complete a No-Spend Challenge.

- Providing moves and budgets to your family, friends, and/or internet followers.

Unlike quiet financial planning, loud budgeting breaks whatever stigma or awkwardness exists around talking about money into the world of normalcy by demystifying it.

Why Gen Z is drawn to Loud Budgeting

- Relatability: Social Media is known for being authentic and ‘real’, and the concept of this is ‘real’.

- Breaking the Taboo: In many cultures (including Pakistan), money is seen as a ‘private’ topic. Gen Z is breaking through that.

- Community Encouragement: When they are loud about it, they can support and encourage one another.

- Transparency: Many of them show what they are spending in their budgeting; they aren’t showing off their wealth.

Loud vs. Traditional Budgeting

| Feature | Traditional Budgeting | Loud Budgeting |

| Privacy | Private & hidden | Open & public |

| Accountability | Self-only | Peer & community |

| Focus | Numbers & rules | Lifestyle & transparency |

| Emotional Angle | Stressful, lonely | Supportive, empowering |

Loud Budgeting and the Psychology Behind It

Psychologists maintain that making goals public increases the likelihood of sticking with them. The uses accountability as well as positive peer pressure to enhance the practice of financial discipline.

Benefits

- Developing solid financial discipline

- Creating awareness around saving

- Growing financial literacy

- Normalizing saying “No” to unnecessary expenditures

- Adopting mindful living

Challenges and Critiques

- Of course, not everyone subscribes to this trend.

- Some critics observe that oversharing one’s private life.

- Other critics engage in comparison anxiety.

- There are cultural obstacles: In Pakistan, money is often taboo to discuss openly.

Nonetheless, loud budgeting is generally positive. Risks far outweigh benefits, especially for a generation using to create new financial customs.

Loud Budgeting, Social Media and Culture

- The presence of loud budgeting on TikTok, Instagram, and Twitter is palpable with finance challenges such as:

- “No-Spend September”

- Cash Stuffing Challenge

- “Budget With Me” vlogs

it presents even more opportunities for Gen-Z, as well as Millennials, to actively practice personal finance..

Potent Loud Budgeting Techniques for 2025

1. Publicly Advertise Your Reduced Spending

Put out your income vs. expenses each month on a blog, privately (and with caution, in real life) share with your best friends.

2. Use Social Media to Track Your Dough

Use budgeting wall hashtags (examples: #Loud Budgeting, #NoSpendChallenge) in any social media post.

3. Join Loud Budgeting Groups

Look for budgeting communities online on Facebook, Reddit where like-minded individuals are also chronicling their budgeting experiences.

4. Make Big Aspirational Goals

Publicly declare your goals (example: “Saving PKR 100,000 in 2025”) and publicly post updates on your progress.

Case Studies: Gen Z Loud Budgeting Success Stories

- Sarah (23): spent 40% less after publicizing her monthly expenses on TikTok.

- Ali (25 years / Pakistan): saved for a bicycle by declining hangout invites and updating friends on his progress with announcements.

How Loud Budgeting is Changing The Trends of Personal Finances

It forces banks, apps, and coaches to rethink their approach. Transparency and honesty is the new sales pitch for the financial services market.

Loud Budgeting in Pakistan: A Cultural Change

In Pakistan, sharing money conversations openly is a delicate subject. Although, this mindset is changing slowly with Gen Z. For example, they started:

- Sharing their concerns regarding student loans

- Disclosing their freelance income

- Having honest conversations about saving hacks because of inflation

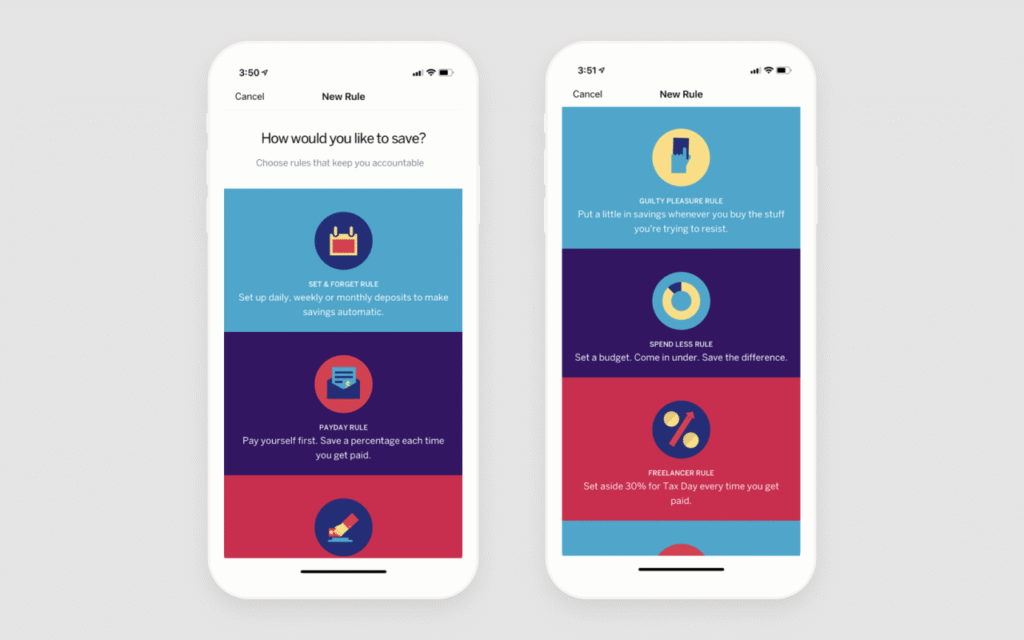

Applications and Tools That Assist in Loud Budgeting

- YNAB (You Need A Budget)

- GoodBudget

- Spendee

- Local apps like Hisaab Kitab

Loud Budgeting and Sustainable Finance

This movement also works in favor of eco-friendly living because by continually saying “No” to unnecessary spending the Gen Z is also practicing sustainable finance.

Future of Loud Budgeting in 2025 and Beyond

Experts predict loud budgeting will continue to grow, affecting:

- Personal finance education

- Transparency at work

- Sustainable money habits

Conclusion

Many things have been said about that the essence of it as a strategy carries the heft of a growing trend fueled by a generation led by Gen Z. The overt, transparent, unapologetic conversations about money are making old taboos disappear while motivating smarter budgeting amongst a generation.

If you are interested in staying ahead of notable personal finance emerging ideas, you could read more inspiring articles on PresentPakistan.com, and start achieving a better financial future now!

FAQs

Q1: What does loud budgeting mean?

Where you are transparent about your financial choices, goals, and limits for some social accountability.

Q2: Why is Gen Z using loud budgeting?

Because it is transparent, relatable and provides community accountability and reduces financial stress.

Q3: Is this safe?

Yes, it is safe as long as you don’t overshare private things like account numbers or salary.

Q4: How is loud budgeting distinct from budgeting?

Traditional budgeting is private, whereas open budgeting is sharing budgets publicly.

Q5: Can this work in Pakistan?

Yes. Although money talk is considered private in Pakistan, loud budgeting is gaining traction within youth communities.

People Also Ask

1. What is loud budgeting?

it would be as saying things like, “I can’t go to this expensive dinner because I’m saving for rent,” posting your monthly expenses to social media, or announcing that you are taking on a “No-Spend Challenge.” Some young GenZers are creating TikToks or Reels on Instagram that document their budgeting process in public for accountability.

2. How does it help you save money?

you save money through public accountability. If you announce your goal out loud, you are less likely to break it simply because your friends, followers or community will see. It also takes away some peer pressure — instead of overspending to “fit in” you feel more confident in saying no. By doing this, you will start to be more intentional about where you spend your money and saving more in the process.

3. Is loud budgeting going to be a trend in 2025?

Yes, it, will be one of the largest personal finance trends in 2025. Gen Z has made it easier to talk about money and has created a more transparent view of personal finance, using social media to normalize the conversations around expenses, saving money and hardships with money. This trend will continue to grow globally and will continue to influence countries such as Pakistan where money talk is often viewed as taboo or too private.