The year 2025 is already becoming a watershed moment for Pakistan’s economy. One of the largest stories being reported around the world of finance is the State Bank of Pakistan’s (SBP) decision to lower interest rates after years of maintaining them at historic high levels. For everyday people, the question is simple: does this mean cheaper loans? Whether you are considering purchasing a new home, starting a business, or simply getting a personal loan, the SBP’s decision will have a direct impact on your life.

Table of Contents

- Reason for Pakistan’s interest rate cut in 2025

- Decoding Interest Rates: A Basic Breakdown

- Effects on Borrowers: Are Loans Actually Affordably Priced?

- Housing Finance and Mortgages: Significant Relief or Small Change?

- Loans for Business & Growth of SME’s

- Impressions on Investors and Savers

- The Role of Inflation and Economic Stability

- IMF, Reforms, and Global Influence

- Digital Banking & Loan Access

- Public Sentiment: How People Are Reacting

- Risks of Lower Interest Rates

- Future Outlook: Will Rates Stay Low?

- Tips for Borrowers in 2025

- Conclusion

Reason for Pakistan’s interest rate cut in 2025

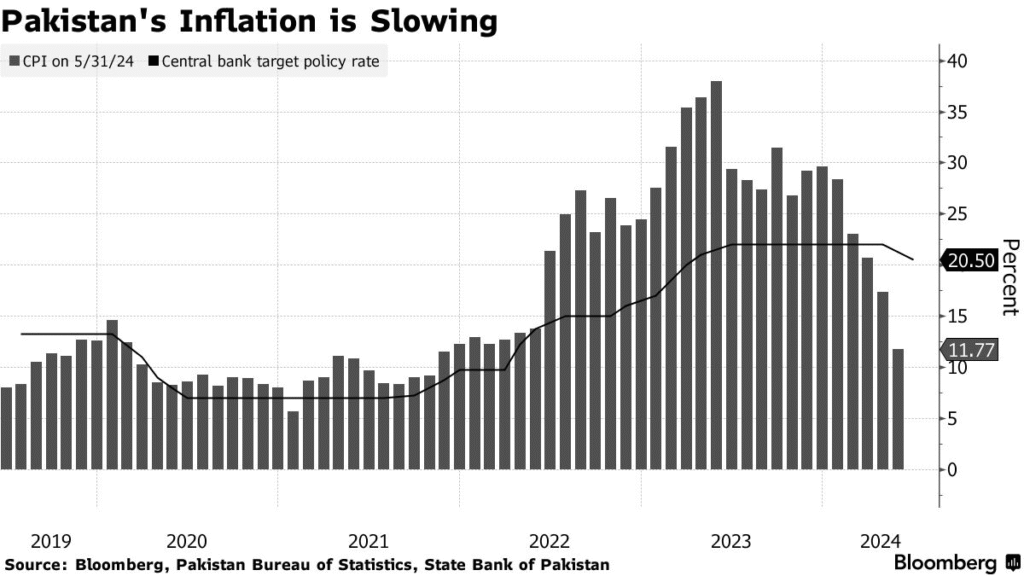

In recent years, Pakistan has suffered from unprecedented inflation and tight monetary policy. Interest rates were held at as high as 22% to support currency stability and tame price inflation.

But with inflation easing back into the single digits, SBP viewed this as an opportunity to nurture growth. Through a rate cut, they hope to:

- Stimulate investment

- Stimulate small and medium enterprises (SMEs)

- Stimulate demand in both housing and durable goods

- Stimulate employment generation

Decoding Interest Rates: A Basic Breakdown

Interest rates can be thought of as the “price of borrowing money.” If the rates rise, borrowing is expensive and borrowing decreases. If the interest rates continue to decline, then borrowing is more appealing.

For example:

- At 22%, a loan of PKR 1 million would cost about PKR 220,000 per year.

- At 12%, you will pay an interest of PKR 120,000 annually, which is a dramatic decline in interest payments.

Effects on Borrowers: Are Loans Actually Affordably Priced?

Yes – loans are cheaper than when compared to the past three years. Banks have started offering:

- Personal loans at a lower monthly installment

- Car finance with lower premiums

- Business loans with a simplified repayment mechanism

Housing Finance and Mortgages: Significant Relief or Small Change?

The housing sector has arguably been one of the biggest beneficiaries of lower interest rates, with worsening affordability geared towards encouraging some middle-class families looking to enter the housing market to utilize mortgage finance.

The banks have, however, maintained their stranglehold on lending standards in housing finance ensuring proper documentation and a good credit rating is established prior to funding housing finance.

Loans for Business & Growth of SME’s

Small and medium enterprises (SMEs), as the foundation for Pakistan’s economy, moved slower due to cumbersome borrowing costs, but with now lower the cost of borrowing:

- Entrepreneurs can borrow cheaper.

- Projects to expand that had been on hold are now re-starting.

- Startups and IT firms can borrow on favorable terms now.

Impressions on Investors and Savers

As borrowers celebrate the changes in loan interest rates, savers and depositors will have additional obstacles to consider. When interest rates go down, they can expect lower returns on their bank deposits while many investors may begin moving funds into stock markets, gold, or real estate, in addition to risking higher investments altogether.

The Role of Inflation and Economic Stability

The effectiveness of reducing interest rates depends on whether inflation remains under control. The SBP will eventually have to raise rates again if inflation rises again.

IMF, Reforms, and Global Influence

IMF-backed reforms also play a part. Pakistan should strive to maintain fiscal discipline and revenue collection even as borrowing becomes cheaper.

Digital Banking & Loan Access

Digital banking and fintech apps are making loan applications more convenient than ever before. The emergence of mobile-enabled microfinance and instant credit assessments are fundamentally changing the process of borrowing.

Public Sentiment: How People Are Reacting

- Middle-class households welcome the decision.

- Businesses are optimistic about growth.

- Critics fear inflation may rise again.

Risks of Lower Interest Rates

- Inflation could rise if borrowing increases too much.

- Currency depreciation risk if imports grow rapidly.

- Savers may suffer from low returns.

Future Outlook: Will Rates Stay Low?

Experts believe interest rates will remain relatively low for the next 1–2 years unless inflation spikes again.

Tips for Borrowers in 2025

- Compare bank offers before taking a loan.

- Avoid unnecessary borrowing.

- Invest in assets that can grow in value (real estate, education, business).

Conclusion

Interest rate cuts in 2025 ushers in something new in Pakistan’s financial landscape. Borrowers and businesses alike will welcome lower interest payments. However, savers are going to have to adjust their mindset. With prudence, this could put the economy in position to enter a long-run growth stage.

Want to learn more about Pakistan’s financial future? Check the Finance category of PresentPakistan.com for new updates and thoughtful views.

FAQs

Q1. What was the motive behind Pakistan cutting interest rates in 2025?

Inflation was slowing down, helping the SBP to support growth.

Q2. Are loan interest rates cheaper in Pakistan now?

Yes, rental, business, and personal loans have become cheaper compared to 2022-2024 interest rates.

Q3. How does low interest rates affect savers in Pakistan?

Less interest is earned on deposits so savers shift to riskier assets.

Q4. With low interest rates, will inflation rise again?

It depends on fiscal discipline and how well the supply side is managed.

Q5. What type of loan will be most affected by the cut in interest rates?

Housing and SME business loans are likely to benefit the most.

People Also Ask

Q1. How does the increase in interest rates impact the average Pakistani family?

An increase in interest rates has the opposite effect of lowering peers, it makes borrowing more expensive. This will mean a higher monthly car loan, higher personal loan repayment, and a higher mortgage. Businesses will also incur more significant borrowing fees, which may prevent job growth and the economy from thriving.

Though any increase in interest on borrowing will simultaneously drive up the interest paid on bank deposits. Savers have the ability to earn higher interest on their deposits, which will combat normal inflation and taxes.

Q2: What is the SBP interest rate in the year 2025?

In 2025 the State Bank of Pakistan (SBP) decreased its key policy interest rate to approximately 12%–13% compared to its previous reduction of about 22%. It showed a substantial decrease, mainly attributed to a steady decline in inflation levels and a desire to stimulate investment & economic expansion. (The exact change will depend on the SBP quarterly revisions)

Q2: Are car loans cheaper due to the interest rate cuts in Pakistan?

Yes, following the interest rate cuts in Pakistan in 2025, car loans became more accessible and affordable, mainly because banks have reduced the markup to lower monthly installments for auto financing. So for middle-class families needing to buy a car, now is welcome relief.